Most Powerful Candlestick & Chart Patterns

Premium ebook Lifetime Validity

Advanced Highly profitable trading patterns

Rs.199 only

Useful for all Stock market segment like…

Sample Photos 👇

Backtested Strategies, Became Trade Like a Pro. 📊📉📈✔✔✔

Trading chart patterns : Total 53 strategies

(1) TYPES OF CANDLESTICKS

Bullish Candlestick Patterns :

- Hammer

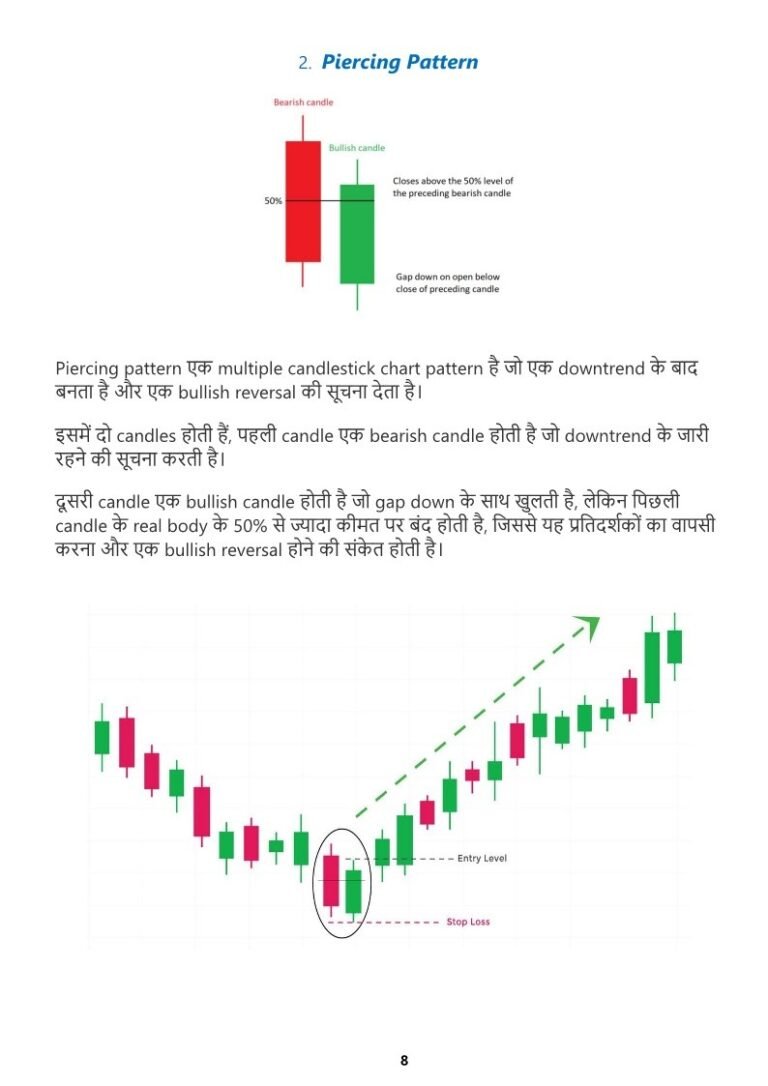

- Piercing Pattern

- Bullish Engulfing

- The Morning Star

- Three White Soldiers

- White Marubozu

- Three Inside Up

- Bullish Harami

- Tweezer Bottom

- Inverted Hammer

- Three Outside Up

- On-Neck Pattern

- Bullish Counterattck

Bearish Candlestick Patterns :

- Hanging Man

- Dark Cloud Cover

- Bearish Engulfing

- The Evening Star

- Three Black Crows

- Black Marubozu

- Three Inside Down

- Bearish Harami

- Shooting Star

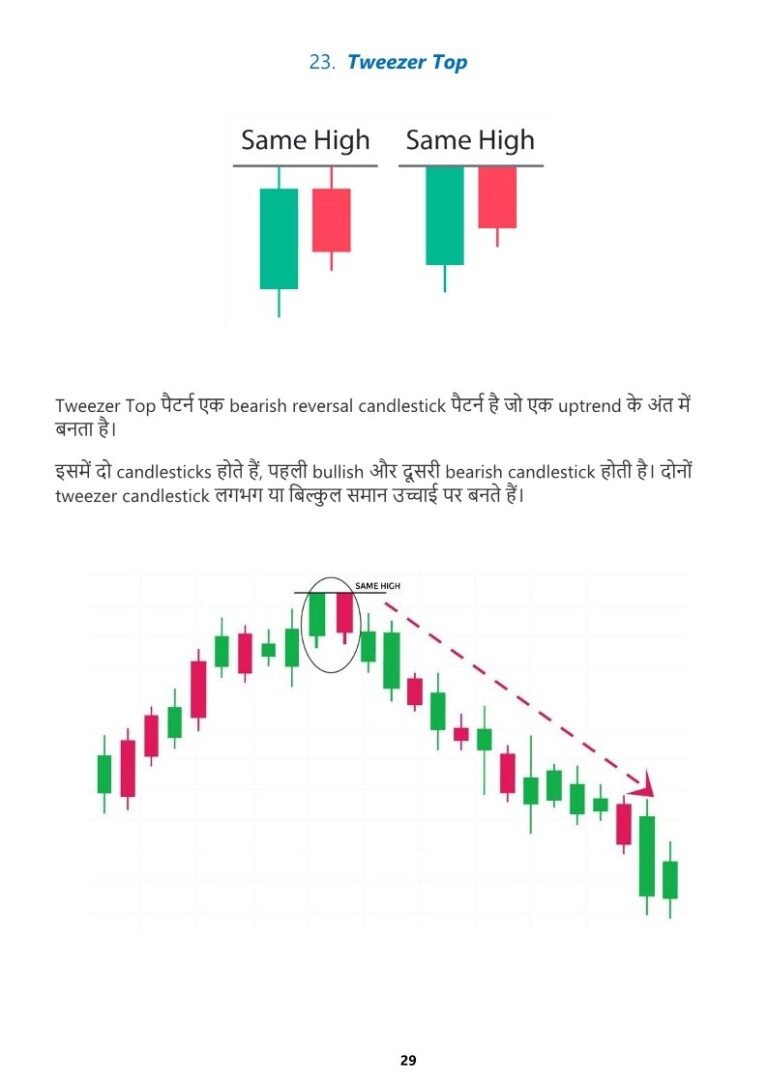

- Tweezer Top

- Three Outside Down

- Bearish Counterattack

Continuation Candlestick Patterns :

- Long-Legged Doji

- Spinning Top

- Falling Three Methods

- Rising Three Methods

- Upside Tasuki Gap

- Downside Tasuki Gap

- Mat-Hold

- Rising Window

- Falling Window

- High Wave

(2) TYPES OF CHART

- Double top

- Double bottom

- Triple top

- Triple bottom

- Head and shoulders

- Cup and Handle

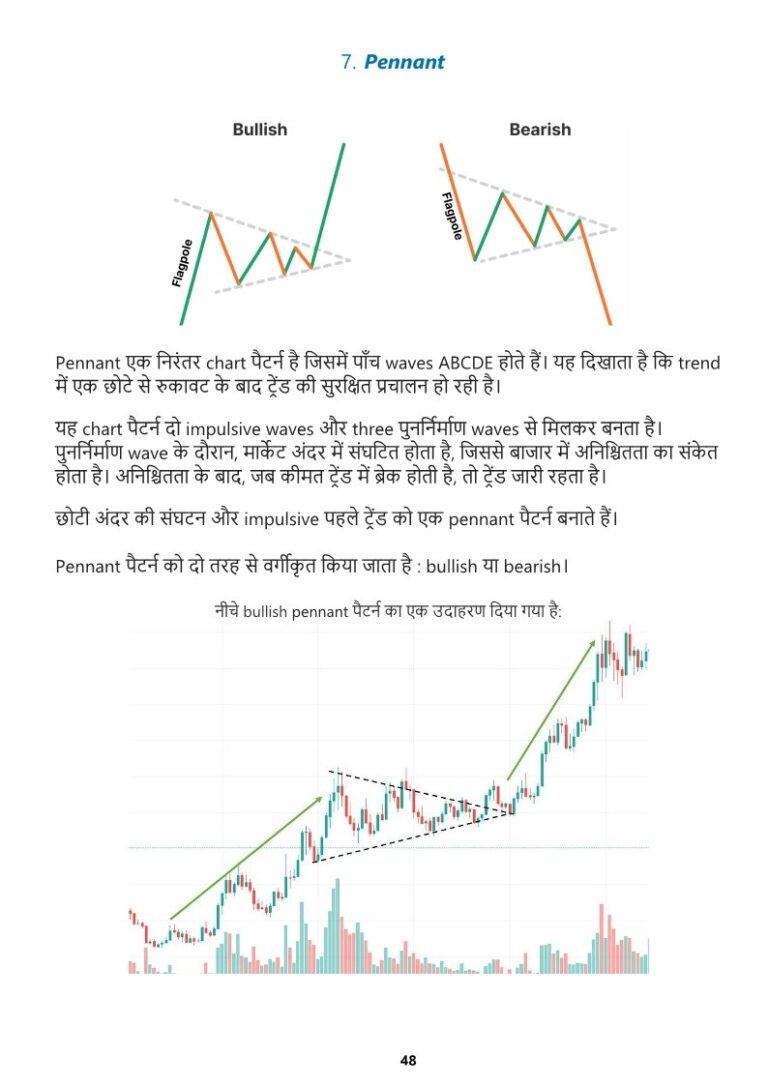

- Pennant

- Wedge

- Diamond

- Descending triangle

- Ascending triangle

- Symmetrical triangle

- Flag

- Broadening / Megaphone

- Bump and Run

- Horizontal trend channels

- Descending channel

- Ascending channel

PRODUCT DESCRIPTION

Candlestick and chart patterns are visual representations used in technical analysis to analyze and predict future price movements in financial markets, such as stocks and commodities. They provide traders and investors with insights into market sentiment, potential trend reversals, and entry or exit points for trades.

After Payment, you will get Download link on your Email instantly.

STILL HAVE QUESTIONS? WE'VE GOT YOU COVERED!

What I Will Get After Purchase?

After successful Payment You can Download All Instantly. You will be redirect automatically to another page. From there you can download All Instantly. AND,

You will get Well-Optimized PDF file automatically Just After your Purchase On your Email ID. with DOWNLOAD LINKS.

How I will get Product or Download Product?

After successful Payment You can Download All Instantly. You will be redirect automatically to another page. From there you can download All Instantly.

Is it Available Lifetime?

For your Safe side, we recommend you to download all necessary files and save it in your computer. So that you can access it anytime.

What is the best timeframe to analysis stock market ?

Intraday/Short-term/options Trading: For traders who focus on short-term price movements, time frames such as 5-minute, 15-minute, or 1-hour charts can be useful. These charts provide a detailed view of price action and are commonly used by day traders or scalpers.

Swing Trading: Swing traders typically hold positions for several days to weeks. They often use time frames like 4-hour, daily, or weekly charts to capture medium-term price swings and trends. These time frames provide a broader perspective and help identify longer-term chart patterns.

Position Trading/Investing: Investors and position traders who take a long-term view often refer to weekly or monthly charts. These time frames help identify major trends and are useful for determining long-term investment strategies.